Early Exit #4: Playing It Safe

Chasing the next milestone is preventing you from realizing your dreams.

You’re reading Early Exit Club — a newsletter about leaving the 9-5 workforce to build a $20k/month solo business by Nick Lafferty.

I can’t quit now, I have another stock vest coming up.

I can’t quit now, I have to see this project through.

I can’t quit now, my team needs me.

My friends have said these exact words when we talk about how:

They’re underpaid

They’re overworked

They’re burned out

There’s always a reason not to do something.

Sometimes you want to play it safe.

How I played it safe

I talked about this more in my first newsletter:

But after pursuing FIRE (financial independence / retire early) for the last 9 years I decided I was done working for someone else.

But only after I hit 4 completely arbitrary milestones.

My journal entries from this time are full of justifications for why staying until those milestones made sense.

And they’re all perfectly logical:

Stay for 4 weeks: Go to Portugal

Stay for 4 months: Big savings goal

Stay for 8 months: Vest my equity

Stay for 12 months: My 10 year career anniversary

Our brains are great at making up excuses not to do something.

There’s always another box to check before you’re ready.

Where does it stop?

This is classic One More Year Syndrome, the desire to stay in a job longer to pad your savings, hit a milestone, or keep playing it safe.

When’s the right time?

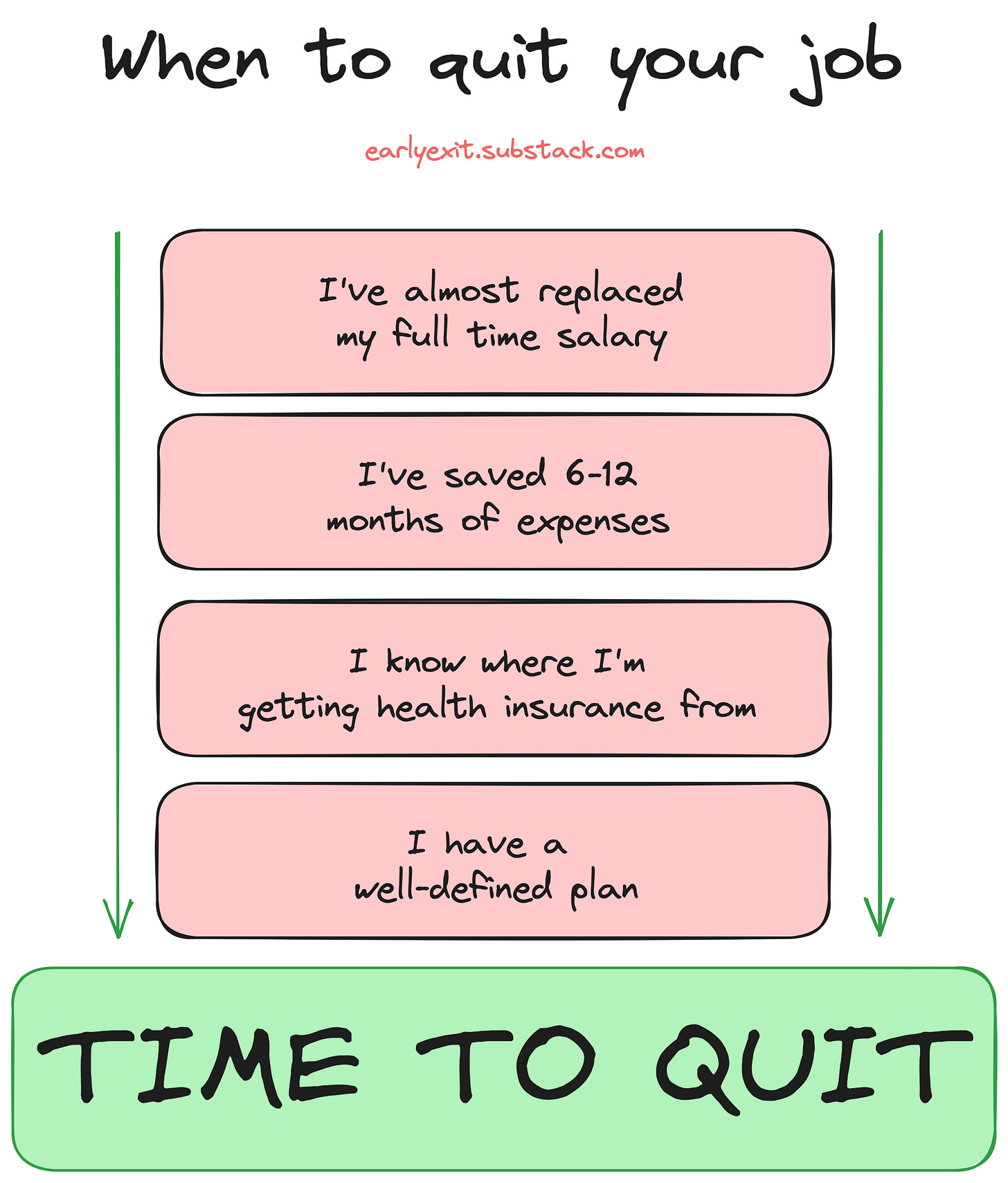

How do you set aside the bullshit milestones and decide on the right time to quit?

Here’s the framework I used:

I’ve almost replaced my salary

I’ll dedicate more newsletters to this topic as it’s arguably the hardest and longest part of becoming a Solopreneur.

By having income coming in, even if it doesn’t fully replace your former salary, it takes a huge weight off your shoulders.

It means not burning through all your savings.

It means having existing levers to pull to increase your income instead of starting from nothing.

Is it absolutely necessary? No.

But building side income while working your regular job lets you freely experiment without the pressure of needing to make money today.

And if your first idea (or your first 3 ideas) don’t work out, you still have a regular job.

It might mean sacrificing some nights and weekends to start building your own thing.

I’ve always found it easier to work on my own projects and dreams than someone else’s, so finding a few hours before or work came a little easier.

Saving 6-12 months of expenses

This is the non-negotiable one to me.

You need to have savings in place before making the leap.

Here’s an example: my HVAC broke two weeks after I quit my job, right as it’s nearing 100 degrees outside(37C).

Did it suck? Yeah, but I wasn’t worried about the money.

I had more than enough savings to cover it without thinking twice.

And that’s the goal here: save enough to where you’re not stressed when life inevitably happens.

To figure out your monthly expenses, use a tool like Tiller (this is an affiliate link) to automatically download your financial data into a spreadsheet.

This is exactly what I use to track my income and cost every month.

Track your expenses for a few months to understand how much you spend in an average month.

Multiply that number by 6 or 12 and stash that amount of money in a high-yield savings account (they’re paying a historically high 4% interest right now).

Figuring out health insurance

Here in America our health insurance is tied to having a job.

Our employers provide healthcare for us and we have to pay a percent of the monthly premiums.

I’ve paid anywhere from 1% to 50% of my company-sponsored healthcare insurance before.

But now because my wife and I both work for ourselves now we have to pay for 100% of it and shop for health insurance on the Healthcare.gov marketplace.

We’re fortunately young(ish) and healthy but we still need something that will protect us in case of emergencies. .

So after some shopping around we found a plan for $640/month.

This was the worst part of starting my own business so far 😄

Having a well-defined Exit Plan

I knew exactly what I was going to do after I quit:

ramp up my consulting to bring in short-term revenue.

focus on my income generating assets to invest in medium-term revenue.

learn to code to build a long-term asset.

Now a month later I’m considering pivoting on the long-term idea, but only because I have existing revenue coming from other areas.

This topic will be explored more in another newsletter, but the idea here is to quit towards something.

Maybe your exit plan means taking 3 months off to travel and decompress first.

I jumped right in because my motivation was high and I wanted to take my momentum to launch something new (like this newsletter!).

But have a rough plan before you make the jump.

And it’s ok to change it along the way.

Right now

I quit my job after realizing all my milestones were made up bullshit.

I realized that the right time is always right now.

Over the Christmas holidays last year I spent a lot of time trying to make music.

One of the things I made is an inspirational ambient track that samples one of my favorite Youtubers.

I’m sharing it here with you, the very first time I’ve ever shared it with anyone, in the hope that it helps inspire you like it’s inspired me.

Are you going through the same struggles?

If you’re one of those people who’s considering leaving a job or jumping into self-employment after a layoff, I’d love to chat with you.

Hit reply and we can setup some time to talk.

Tell me about what’s keeping you at your job or preventing you from going all-in on yourself.

I’m here to meet other people going through the same things and hopefully inspire a few of you :)

Until next time,

Nick

No promises on my illustration skills improving. You’re stuck with me and my general lack of artistic talent.

All quotes here and the sample from my song are from Casey Neistat’s video The Most Dangerous Thing in Life. 100% worth watching the source material :)

I couldn’t do the illustrated headers this time because Substack says my email was too long :(

Hot dog, look at that new hat! Grab yours here.

Great post, Nick.

I'd love for you to explore the top item on this hierarchy further (replacing salary). While it makes sense to put in place revenue levers that you're confident you can scale with more time, the idea of matching one's salary seems more like one of the BS milestones/gates you describe in the rest of the post. Matching salary before one has left their job seems highly unlikely - so how much is "enough"?