Early Exit #27: How Startup Equity Works (Loom Example)

Equity is a risky and confusing form of compensation that is foreign to most freelancers.

You’re reading the Early Exit Club — a newsletter about leaving the 9-5 workforce to build a $20k/month solo business by Nick Lafferty.

Last week: December finance update

Next week: How to nail your positioning as a freelancer.

Australian software giant Atlassian acquired Loom for just shy of a billion dollars on October 12th, 2023.

Despite working for 3 companies that were acquired (for $60 million, $2 billion, and now $1 billion respectively), Loom was the first time in my career that I had vested equity in a company and the first time I financially benefitted from an acquisition.

I had a lot of emotions that day but today isn’t about emotions. It’s about numbers and how having equity in a startup is like owning a lottery ticket that could turn into a big pay day down the road.

But exactly how big of a pay day are we talking? The answer depends on a few things:

How early you joined the company (the earlier you join the better,)

How much the company gets acquired for (because the investors get paid back first before employees)

Terms like your strike price, the preferred price per share, and the company’s 409a valuation

If those words don’t mean much to you then stick around because I’m going to use the Loom acquisition to share what I know about how equity in startups work. I am by no means an expert so I will link to other resources to help explain my points as we go.

By the way, it’s 100% possible for freelancers to ask for equity. If you’re curious about how you can get equity as a freelancer then this post is for you:

To keep with my theme of ultra-transparency, today I’m going to do the uncomfortable thing and tell you all about how I financially benefitted from Loom’s acquisition.

But the dollar amount isn’t what I want you to remember. I want you to remember the potential risks of equity compensation and that even a billion dollar exit might still mean you don’t get that much money in your bank account.

Let’s start with a quick refresher on the types of equity compensation.

The types of equity compensation

There are three ways that employees can receive stock in a company:

Stock options (either ISOs or NSOs)

Stock units (RSUs)

Employee Stock-Purchasing Plans (ESPPs)

Comparing the three is outside the scope of this article, but everything I talk about here will refer to stock options.

An option is the ability to purchase a set amount of shares in a company at a pre-defined price.

You do not own any equity until you purchase your options. This is very important.

You also do not gain access to your options on day 1. More on this in a second.

My initial option grant at Loom

I was granted 37,609 options upon accepting my initial offer at Loom.

These options were valued at $611,992 which puts the price per option at $16.2. This is known as the preferred price, which is what investors paid to invest in Loom during their Series C round in May of 2021.

But I didn’t have access to these options on day one. They have to vest.

Equity Vesting Schedules

A vesting schedule is a pre-determined amount of time where you actually earn your initial equity grant.

The above image shows the most common 4-year vesting schedule with a one year cliff. The cliff means you don’t vest any equity until you’ve been employed at the company for at least a year.

After a year passes you vest additional equity every month in an even amount until the end of your vesting period.

I only stayed at Loom for about 2 years so let’s calculate how many options I vested.

Vested Options

I vested a total of 15,670 options at Loom, or 41% of my initial equity grant.

After I hit my vesting cliff, I’d get emails like this every month from Carta (the company Loom used to manage their option pool).

That email was the last one I received before my employment with Loom was officially terminated.

My initial equity grant came with a 1-year post termination exercise window, which means I had until March 19th 2024 to exercise my options in Loom before they expired.

The most common post-termination exercise window used to be 90 days, but I’ve seen companies give up to 10 years to exercise your options.

The longer the better because exercising means you cut the company a check to purchase your equity which can be really expensive.

How much would that have cost me?

Exercising My Loom Options

As a dedicated personal finance nerd I had been keeping track of my vested options at Loom and calculating how much cash I’d need to exercise them.

How much it costs to exercise your options is determined by your strike price, which is included in your initial equity documentation.

My initial strike price was $4.90 but Loom did a re-pricing in 2022 that lowered all current employee’s strike price to $3.24 based on current valuations for startups (honest thanks to the Loom finance team for doing this, it saved everyone a ton of money down the road).

To exercise my 15,670 options I’d need to cut Loom a check for $50,770.80 (15670 * $3.24) which is a lot of freaking money to give to a startup during the wave of tech layoffs in 2022 / 2023.

Because I loved Loom (the product, the company, and the problem they solved) I had been saving cash to exercise my options, but I still was hesitant to cut them a check.

So instead of exercising my Loom equity, I bet on myself and launched the Early Exit Club. The cash that I had saved to exercise my Loom equity became my personal runway to launch my consulting business and give me a cash buffer in case it took a long time to build a business.

But I lucked out, because if Atlassian had acquired Loom after March 2023 then I would’ve received $0.

So how much money did I make?

After taxes I received $73,848.82 in my bank account. This is a very nice amount of money to magically appear one December morning and I am lucky and blessed to be in this situation.

That number is after taxes. Loom withheld 22% of my payout for taxes, so before taxes I made about $94,677.97.

But hang on a second, my initial option grant was valued at $611k and I vested 40% which means I should’ve earned $244k, right?

I wish!

But what happened? Two things:

The price Atlassian paid for Loom was less than investors paid in their Series C round 😬

I still had to exercise my options, and that amount was deducted from my payout.

Even though I had not officially exercised my options because I was within the post-termination exercise window Atlassian had to purchase my outstanding equity.

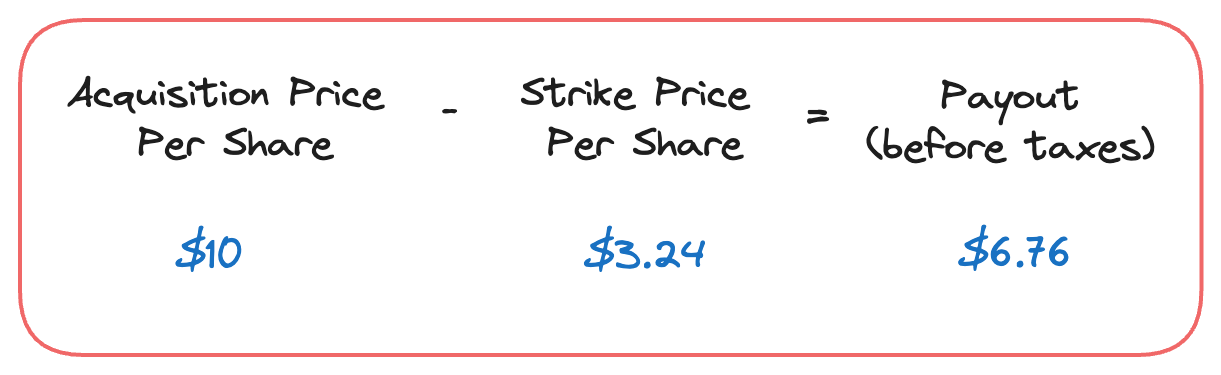

Here’s what the math looks like per share.

My vested options were worth about $150,000 at the price Atlassian paid for Loom, which is a ~37% discount compared to the Series C valuation 🫠

I am insanely lucky

90% of startups fail.

So for me to financially benefit from Loom’s exit means I am incredibly lucky and I do not take this for granted at all. But also, Loom sold for a billion dollars and I netted less than $100k. Where did the rest of the money go?

Pretty easy answers:

Investors

The founders

Early stage employees

All of those people are super deserving of their likely massive payout because they bet on Loom (either with their dollars or with their time) super early on.

But comparison is the thief of joy and I’m personally happy to have closed the Loom chapter of my life with a win.

What next?

Despite not making huge amounts of money from the Loom acquisition I am still building equity into my consulting deals where possible.

I want to continue stacking lottery tickets in the lucky event that one of my clients also has a successful exit. Having equity in a company also aligns my incentives towards the long-term success of the company, it’s a win/win for freelancers and startups as long as you can afford to take the cash pay cut in exchange for equity.

But many freelancers I know don’t even know they can ask for equity, and no one is going to magically give you equity in a company unless you ask.

I hope this very real example helps some of you understand what happens if you have equity and the company sells. It’s still a very risky form of compensation to accept and even if a company exits there’s still a chance you get nothing (which hurts even more if you exercised your options and don’t break even).

If you made it this far, thanks for sticking around and I hope you enjoyed another voyeuristic look into my financial life.

Next week I’m hoping to finish use a framework typically applied for building new products to position your consulting practice for success.

It’s about how you can message yourself to prospective clients that clearly demonstrates you experience and value, because most freelancers really struggle with this (myself included).

See you all then,

Nick

No picture this time because it would put me over the Substack limit for email length :(

Did someone send this to you? First, tell them thanks. Second, maybe you should subscribe too?

You’ve explained all this so clearly! Thanks for sharing and for being transparent about what you made, Nick.

This was an incredibly valuable peek behind the curtain, Nick! Thank you for sharing! As someone who's never actually been a full time employee, these non-traditional options you've shared are so useful!