Early Exit #5: June Finances (Full Month)

You’re reading Early Exit Club — a newsletter about leaving the 9-5 workforce to build a $20k/month solo business by Nick Lafferty.

Intro

Hello and welcome back to this month’s edition of financial oversharing.

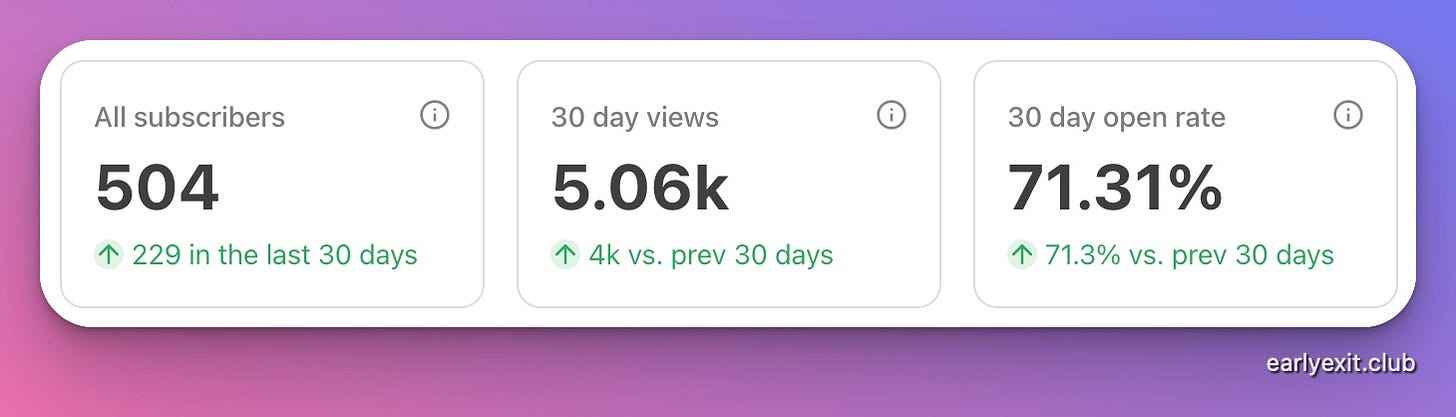

First, I owe all 504 of you a heartfelt thank you:

If you’re new here: thank you for subscribing.

If you’re an OG subscriber: thank you for sticking with me.

If you engage with my LinkedIn content: I appreciate that so much.

If we spoke on Zoom recently: thank you for taking 30 minutes to hop on a call with me.

This monthly post is where I share a detailed accounting of both the spending and income sides of my Solo business from the previous month.

The spending is everything it takes my wife and I to live, including our mortgage, groceries, unexpected expenses, and other living expenses.

Income is the net income I received in my bank account that month across a few income steams.

The goal is to provide an honest look at what it takes to survive as a Solopreneur.

So how’d we do this month?

Income is up!

Spending is also up!

I lost $44!

I signed a new client!

Read on for the details 😊

June Finances

I thought it would be helpful to show my actual budgeting dashboard.

Every Monday I go into Tiller and categorize my transactions which Tiller then nicely rolls up everything into this report.

The dark blue lines are my budget, and the red and green lines are my actual spending and income totals.

If you’re thinking about quitting your job I’d highly recommend starting to track your monthly expenses using a tool like this.

A great goal is to grow your side income to cover your fixed expenses every month.

Think about it: if you can cover your expenses every month with work you’re doing part time, imagine what you could do if you focused on it full time?

My fixed monthly costs are about $5,000/month but yours might be higher (for my friends in NYC and SF) or lower.

This isn’t meant to be an ad for Tiller but they have a free 30-day trial if you’re interested.

Website Traffic

🟢 Up 3.42% (43.8k → 45.3k )

My website traffic continues to slightly increase despite some expected summer seasonality.

This is likely due to my extreme content refreshing and publishing cadence over the last 2 months.

In June I wrote 11 new articles on my blog across a few topics:

More Notion template roundups

Posts on quitting my job and becoming a Solopreneur

Some affiliate-focused pages that compare two tools against each other

This follows May where I refreshed 8 articles and wrote one new one.

Focusing on my website content is the best input metric I can influence right now, as more website traffic means:

More display ad revenue

More potential affiliate income

Consulting

🟢 Up 93% ($1,484.54 → $2,870.40)

I help B2B SaaS startups acquire more users through paid ads, SEO, and affiliate marketing.

My consulting work falls into two buckets:

Advisory (I tell them what to do)

Operational (I do the work myself)

Advisory work has lower time requirements, typically an hour every week or two.

Operational work has higher time requirements because I’m building a strategy, launching campaigns, and working closer with the team.

In June I was paid for May’s consulting work from 2 clients.

I worked my full time job for 12 days in May and I took a week off so I really only had about 10 days to ramp up my consulting time.

At the end of June I had a total of 4 clients and 3 of them had billable work that month.

That means my expected July payment is going up and I already know exactly how much that’ll be.

Now that I have four clients my August payment will be even higher.

I’m also pretty much maxed out on the amount of time I want to spend consulting each month.

I still look at consulting income as short term.

Too much consulting borrows time and effort away from building more sustainable income sources.

You can read my earlier post on Consulting here for more context including how much I charge.

Affiliate Income

🟢 Up 47% ($3,099.43 → $4,568.98)

I thought it would be helpful to graph my affiliate income going back to August 2022.

January through March of this year were great months and then things really dipped in May.

I covered the why behind the dip in my last newsletter, but the short answer is I was impacted by a Google algorithm update for the first time since owning my website.

I’m starting to recover now but it was a good experience to go through as it’s bound to happen again.

I’m expecting affiliate income to start climbing again as we get into September.

It took years of writing to grow my website to this kind of affiliate income.

And it’s highly volatile. Even though I had a $10k/month it quickly dialed down to less than $4k in May.

I’m always a little paranoid that this could disappear at any second which is why I’m so focused on creating new website content and exploring additional channels (more on this later).

Spending

I detail my total spending for two reasons:

I want to show the full picture to be as transparent as possible.

My business itself is very cheap to run.

My main business expense are SaaS tools that average $100/month.

In June I had two major expenses:

My HVAC broke and cost about $2,500 to fix

We had to pay for a month of health insurance of $642

The health insurance payment is unfortunately a fixed cost through the end of the year, but hopefully my HVAC doesn’t break again 🙂

Minus the unexpected repair bill, my fixed monthly expenses are $5,000/month ($60,000/year).

Project Updates

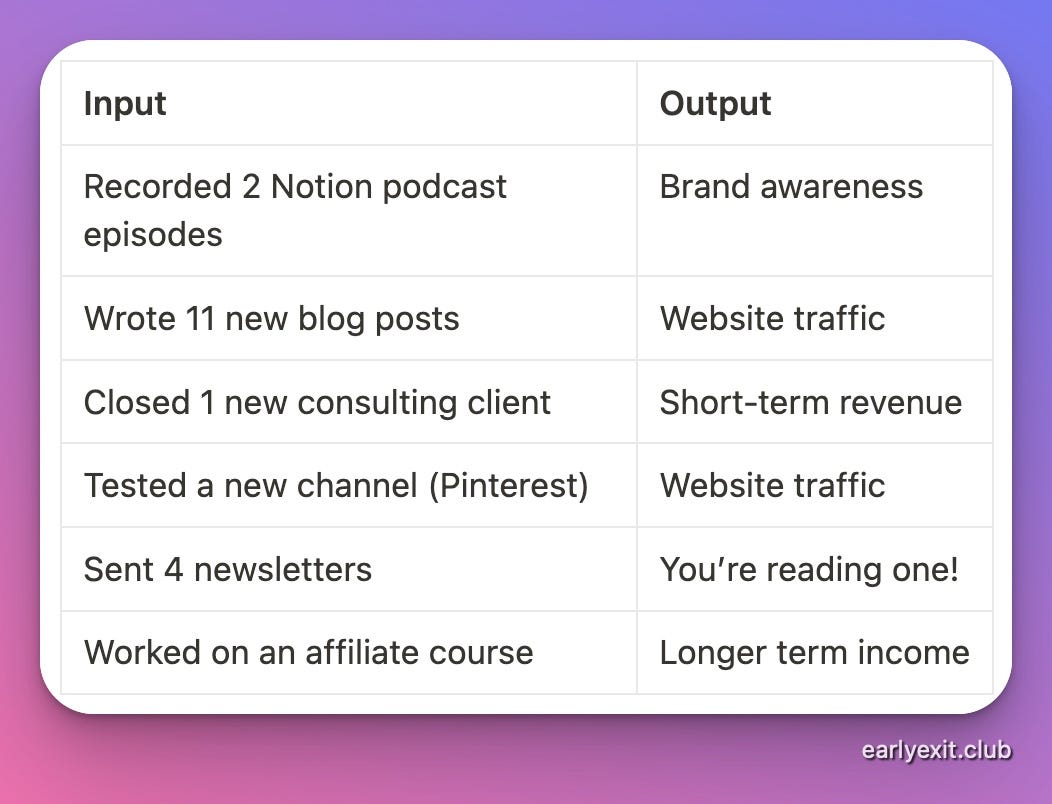

Here’s what I worked on last month:

And here’s what I plan to do in July when I’m not working for my consulting clients.

Pause my Notion podcast: I really like doing this but it takes a lot of time and doesn’t have a clear place in my Early Exit Club branding. I’d like to start a new podcast focused more on people who recently quit or want to quit their job.

Take TikTok Seriously: I’m bullish on TikTok as a channel and I need to buckle down and give this a solid go. I think it could be a great source of subscribers to this newsletter and I have ideas to repurpose my newsletter content into short form videos.

Launch my affiliate product: I’ve spent a lot of time building a course on how to make affiliate income by selling Notion templates. I’m almost done and just need to get this over the finish line.

Continue posting on LinkedIn: LinkedIn is the largest source of subscribers to my newsletter and my content performs best there.

Introducing Rewards

Substack added a reward feature and I just turned it on.

You can get free stuff by sharing the Early Exit Club with that friend who’s always talked about quitting their job.

How to participate

1. Share The Early Exit Club. Click this link to share!

2. Earn benefits. Here’s what you can earn by referring your friends

A handwritten thank you note for 10 referrals

One of the books that inspired my to take this journey for 25 referrals

An Early Exit Club hat for 50 referrals

Wait, before you go

Do you have any feedback on how this newsletter could be improved? Hit reply and drop me a note.

I want to make this as useful for you as possible.

My next newsletter is a more tactical look at creating an Early Exit Plan and covers the steps to take before leaping into self-employment.

I’ll see you then!

Sincerely,

Nick

That sweet hat above is available for purchase here in 7 different colors, or by referring 50 people 🎉.